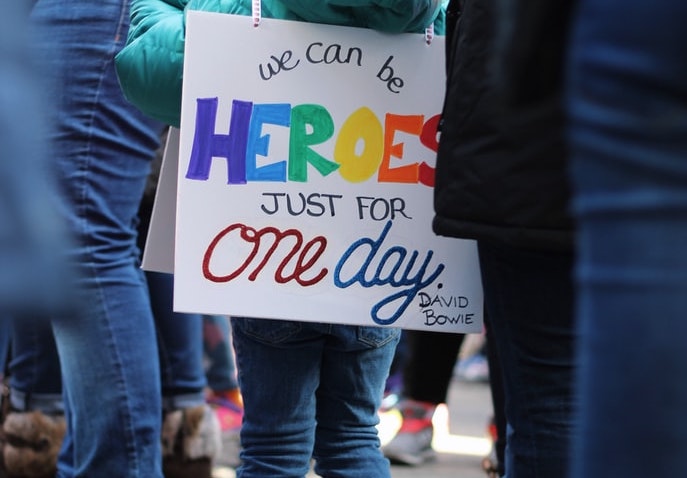

Being a PowerUp Hero is all about being an agent of change. To this end, I get a lot of questions from people who are interested in learning about how to start a nonprofit organization.

So, do you want to start a nonprofit organization? PowerUp Hero shares what you need to know about establishing a nonprofit.

These are the basic steps to start a nonprofit:

- There are more than 25 types of tax-exempt nonprofit organizations in the U.S. The most common are 501(c)(3) charitable organizations, 501(c)(4) social welfare organizations, and 501(c)(7) social clubs.

- Before applying for 501(c) status, an organization must register as a nonprofit corporation by filing articles of incorporation. Business filings are handled by the Secretary of State office in your state.

- Eligible organizations may use the simplified Form 1023-EZ to apply for 501(c) status. However, organizations that receive tax-exempt status using the streamlined application instead of the full Form 1023 may have a harder time accessing grant funding.

- Nonprofits that fundraise across state lines may need to file charitable registration solicitations.

In addition to filing paperwork, new nonprofits must establish a board of directors and bylaws.

- Every nonprofit board of directors requires a chairperson or president, a treasurer, and a secretary. Likewise, there are certain duties and responsibilities that every board must fulfill.

- The best nonprofit boards reflect the communities they serve. Recruit board members who share your mission, have the time to serve and understand good business practices.

- Writing bylaws is one of a board’s first responsibilities. Bylaws establish a nonprofit’s purpose, set procedures for the board of directors, and include provisions for conflicts of interest, committees, and changing the bylaws.

Managing a nonprofit and maintaining 501(c) status requires ongoing attention to legal and tax compliance requirements.

- 501(c)(3) organizations are exempt from federal income tax. However, a nonprofit may have to pay other types of tax. This includes payroll taxes, sales tax, and unrelated business income tax. Use a three-prong test to determine whether you owe UBIT on nonprofit income.

- In addition to tax compliance, nonprofits must file an annual Form 990 with the IRS, comply with state business filings, and continue to hold board meetings and follow bylaws.

You will also want to find ways to spread the word about your nonprofit. This could be as simple as sharing information on social media.

- Work with a marketing firm to help you put together a campaign that can reach members of the community and those who can help your nonprofit grow.

- If you don’t have the money to hire a marketing team, use word-of-mouth strategies. Consider starting social media accounts and promoting yourself there.

- You can use a free online flyer maker to put together an eye-catching graphic that’s easy to share on platforms like Facebook, Instagram, and Twitter.

Nonprofit organizations are held to higher standards than most businesses. This makes starting a nonprofit and maintaining tax exemption a complex process. However, along with the responsibilities of nonprofit ownership come important benefits that enable organizations like yours to make an impact.

Join the community to start a conversation: https://www.powerup.network